Without having a commerce background, the concept of Petty Cash in QuickBooks might be a new term for you. Questions like what is Petty Cash? What is its purpose? Why does a user need it? might be arising in your mind. The answer is to your very first question is that Petty Cash is accessible storage of money kept by the organization for small expenditures. The aim of this is to allow sales and purchase of secondary items that require only a small amount. Maintaining an account for such small transactions is more viable instead of recording them separately.

In this article, we will cover the concept of Petty Cash as a whole in QuickBooks. We will provide you with information on what is the purpose of this feature in the program, the benefits that come along with it, and more.

What is Petty Cash in QuickBooks

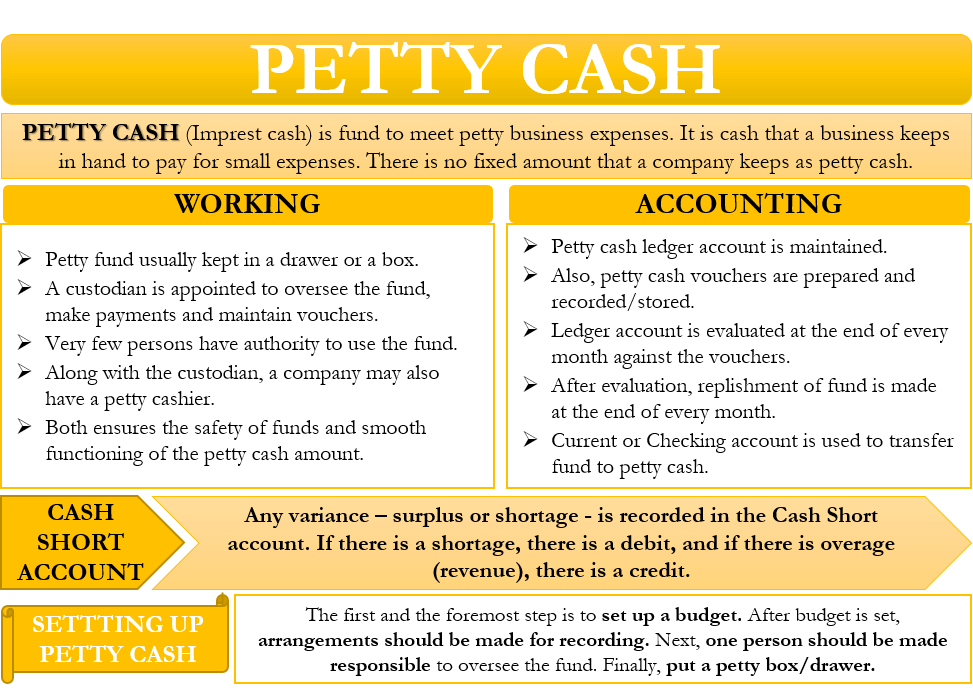

It is the method of tracking your petty cash amounts by making a petty cash account. You can set up your account, transact, record, petty expenses, and accounting. It is in the form of cash used for expenditures. This software is one of the best cash daybooks used in keeping the book.

Why to Set Up Petty Cash for Business

You can make your tiny transactions without much bother. You can buy stamps, food, snacks for customers, and record them in that account. QuickBooks accounting software allows you to maintain and use the petty cash account in your software smoothly. There are some other advantages the feature brings along with it-

- Minimal risk and secured: By maintaining the petty cash account, the risk of keeping cash in your hand is reduced and it is very secured. So it is completely safe.

- Convenient to use: It is easy to use as it provides us a convenient supply of cash whenever we need to make small transactions.

- Specified manner: Petty cash account records all the transactions in a specified manner. Which provides more clarity and keeps all your spendings in a manner.

- Reduced paperwork: In QuickBooks, you can keep long term transactions. So there is no need to do a lot of paperwork now. QuickBooks will do that all for you.

How to Set Up Petty Cash in QuickBooks

The procedure of setting up Petty Cash in QuickBooks is quite easy. Follow through the steps carefully for the best results.

- First, reach out to the settings and select the chart of accounts.

- Next, select New.

- From the account, type drop-down ⇓, and click Bank.

- From the detail type drop-down ⇓, select Cash On Hand.

- In this step enter the petty cash for the account name.

- When you move money from the checking account by writing a check or transferring funds, the opening balance will be created.

- Finally, select Save and Close.

Managing Petty Cashbook

Now that you have created the Petty Cashbook, it is time to put some money into your account. Also, keep an update of your petty cash.

As you know, where you have to put your cash in

- Take some cash from your checking account and put it in a locked cash box.

- Maintain a record of the transactions in QuickBooks Online.

- If I had written a check for cash: Choose to create new⊕ and then check. Then, choose petty cash as the payee. And choose to ➕ add new. If petty cash is not there in the payees’ list.

- If you didn’t withdraw your cash without writing a check: choose to create new⦽ and then transfer.

Other Useful Resources:

Recurring Payments In QuickBooks: How To Setup And Cancel

Taking Out Cash

- When you give cash to the employee, we make a record with a paper slip. This contains to whom, which, where, and for what the money was used. This is like a receipt that is used to track the cash that you had.

- For all the times, the amount on a slip of paper and the cash you have left should add up to the amount you deposit in the box

Here is a video for you. With this, you can set up your petty cash amount in QuickBooks successfully. Have a look;

How to Do Cash Accounting and Recording in Petty Cash

Accounting:- This accounting involves establishing petty cash policies, setting up a cash log, and creating journal entries. Accounting can be done manually with bookkeeping software and an expense card.

Recording:- Record is the major component of the petty cash as it keeps all the records of withdrawal of the money and puts it into the cash box. It is the bookkeeping of every transaction.

Step 1: Policies And Procedures

- It is to assign a person to be in charge of petty cash. It knows petty cash custodian.

- There should be someone to whom you can trust to adhere to the petty cash procedures.

- This is to inform all the employees that receipt is mandatory for all petty cash purchases.

- A receipt scanner will help you to scan your receipt that help you to be safe in future use. In case you lost the receipt.

- The cash account should be monthly basis friendly relation or each time to restore.

- The cash purchase records every month in the books to maintain a record.

Step 2: Set Up A Petty Cash Log

This cash log details all the deposits and withdrawals made from the petty cash account. It includes all the information and also a brief description. Such as what purchase, to which account is to change, who receives the funds, and who grants it. So, you should keep all your monthly information.

Step 3: Record A General Record Of Petty Cash

At least once a month, cash transactions should be recorded. You can use accounting software like QuickBooks and also a spreadsheet to keep track of your income and expenses.

These purchases recorded an increase (as a debit) to an expense account and a decrease (as a credit) to a cash account.

Step 4: Restore The Relationship Between The Cash Account

Generally, it keeps all the information of the cash account it keeps all the journal entries for future use.

We hope, with the given data, you are now familiar with the Petty Cash feature and will be able to use it and benefit from it. But, if you require more information, you can contact us through our customer support using the toll-free number. Our team of experts and ProAdvisor will be ready to provide you with the related service. Also, you can get in touch for any queries related to QuickBooks.