EnterpriseThought is here with a special demanding article for all aspects of QuickBooks Certifications. In this article, we have tried to make the process of the examination simpler by providing the QuickBooks Online Certification exam answers 2022 sample. It is 100% sure that, this article will be very informative for all the aspects, and will help to make a good preparation for the examination.

Things to Keep in Mind Before the Test

- You must pass all modules with more than 80% marks.

- You have only three options for each module.

- Modules can be taken in any order.

- All modules are independent of each other, but if you fail a module three times, it means that you will fail the whole test.

- If you do not pass the test in three attempts (even just one module), you will have to wait 60 days to pass the test again and all the modules (9 modules passed the first time. No matter) only one section failed 3 times).

QuickBooks Online Certification Exam Answers 2022 Sample for Practice

Practice with all of the questions mentioned below for the examination.

1. What are the differences between ITEMS and ACCOUNTS?

- Items: products and services that you sell. They are used on transactions such as invoices and purchase orders. All items must point to an account.

- Accounts: categories in which financial transactions are organized into reports, such as profit & loss and balance sheet. Some accounts carry balances such as accounts receivable and accounts payable; some accounts report information over a period of time, such as income and expenses.

2. What is the difference between accrual and cash basis?

- Accrual: It represents financial transactions and activities as they occur, such as rent expenses that always exists every month and are recorded whether they are paid or not. Only in Accrual basis, you will have accounts payable, accounts receivable, prepaid expense asset and customer deposit liabilities when there is a difference the time the transaction happens and the time that the actual payment is made.

- Cash Basis: It will only report income and expenses as they are paid.

3. What are the two primary Reports in QuickBooks (financial statements)?

- Profit & loss

- Balance sheet

4. What is the Undeposited Funds Account?

The temporary account that QuickBooks uses when a payment is received from a client but not deposited in the bank (QuickBooks bank register) yet.

5. What is the difference between Entering a Bill (and Bill Payment) and writing a check?

- Entering a bill is to incur an expense the moment it exists and it’s paid in the future (Accounts Payable).

- Write Check is to record an expense at the same time it is being paid, no time difference between date of the expense and date of payment. You must use the Pay Bills feature in QuickBooks to mark the Bill (Accounts Payable) paid, using the write check feature would potentially duplicate the expense and overstate your liabilities

6. What do you look for when “analyzing” financial reports?

- Consistency: Such as expenses that are expected to repeat every month and Income matching the business activities.

- Common Sense: do the numbers make sense or are the numbers expected. Generally, there should be no negative numbers unless there is a refund you are aware of.

- Trends and Relationships: such as sales going down or expenses going up. Also the percentage of direct costs vs. revenue, etc…

7. What are the steps to take to accept a customer’s payment and record it in the bank?

- Two Steps: Click of “receive payments” and select client and invoice to apply payment to… this will increase your “undeposited funds” account.

- Then click on Record Deposit after it is taken to the bank and record all payments that are being deposited together in a single transaction to match the bank.

8. What does the collapse and expand button do on standard reports?

It shows or hides sub-accounts.

9. What is a Sub-Account? And why would you use it?

A sub-account is an account that belongs to a main or a parent account and is used to create additional categories (or details) within the main category, for example, Lodging and Airfare are sub-accounts of Travel expenses.

10. How do you get QuickBooks financial reports to excel? And why would you do that?

- Open any report, click on “Excel” button and then create new worksheet. You must have Excel installed in your computer.

- You would export to excel to be able to manipulate the numbers, search for data, statistical analysis, creating graphs.

11. What is the difference between the “Profit and Loss Report” and the “Balance Sheet Report”?

- P&L shows activities: income and expenses to arrive to Net Income (Profit) for a specific time period.

- Balance Sheet shows values: Assets and Liabilities to arrive to Equity (Net Worth) as of an specific date.

- The Net income from the Profit & Loss pass through the equity section in the balance sheet

12. What is the purpose of reconciling the bank account? What are you supposed to do with the transactions that did not reconcile?

By reconciling you make sure that all transactions that went through the bank are also present in your accounting system. Cash transactions that did not flow through the bank cannot be reconciled using bank statements. Items not reconciled are either pending for the following month or, if they are a mistake or duplicated, they must be deleted.

13. When reconciling a bank account, where does the value of the “Beginning Balance” come from? Where does the “Ending Balance” come from?

Beginning balance comes from bank statement and it is also last month’s reconciled balance. The ending balance comes from the bank statement and equals the total amount of cleared transactions.

14. How do you program QuickBooks to repeat a recurring transaction?

Memorize Reports: (CRT+M) Automate Transaction Entry will create automatically the transaction in the future

15. What is the difference between the Cost of Goods Sold and Operating Expenses?

- Cost of goods sold are directly attributed to a sale, they only exist because the sale exists, such as the cost of inventory sold, sub-contractor expense. A total sale minus cogs is used to calculate gross margin or gross profit.

- Operating expenses usually are not directly correlated to a sale and are fixed, such as rent and utilities.

16. What are Classes in QuickBooks and how would you use them?

They are used to create departments or cost centers to measure profits and less for each class.

17. How is the MEMO text box in bills, invoices, checks, etc. useful for report filtering and transaction research?

You can “tag” a transaction with a code, you can search notes within transactions.

18. What Report or Function allows you to view transactions that were changed, modified, or deleted after bank reconciliation has been done?

Reconciliation discrepancy report in the reports, banking menu.

19. What challenges and/or issues can come across when using classes.. Specially on a balance sheet by Class?

Unclassified transactions. Balance sheet by class can have issues with unclassified or unbalanced transactions.

20. What financial reports should you prepare at the end of the year in order to prepare for tax preparation or other types of financial reporting?

Profit & Loss, balance sheet A/R Aging, A/P Aging, Inventory Valuation Summary, sales by rep, Profit by job, etc..

21. How would you “fix” a customer deposit that was entered as income straight into the register, but then you realized that the invoice belonging to that deposit still shows an open balance?

Change the deposit to use the account “accounts receivable” OR delete the deposit and use the “receive payment/Record Deposit” workflow.

22. In your own words, what does it mean to be an “Advanced QuickBooks User”?

Create custom reports, be proactive to potential users understanding differences between different versions of QuickBooks, knowing how to describe reports, search and find information and confidence to work with multiple QuickBooks files.

Other Useful Resources:

Manage, Set Up and Track Inventory in QuickBooks Online

23. What is the difference between a Custom Summary Report and a Custom Transaction Detail Report?

- Summary: Contains totals for a customer or vendor / totals for a particular account

- Detail: Line by line, transaction by transaction, Itemized transaction.

24. What does it mean when you have a negative Inventory? What can you to do troubleshoot inventory issues?

Selling inventory you don’t have. Troubleshoot inventory by pulling a “quick report” on the particular item & looking at all the times the inventory came in or out to find discrepancies.

25. What tools are available to “figure out” QuickBooks issues… in other words where can you go for answers for questions on how to do certain things in QuickBooks?

The QB Help menu, user guide, search intuit support website, videos in YouTube, tutorials on the web, email trusty accountant, Hector’s Bog, and “google” the question at hand.

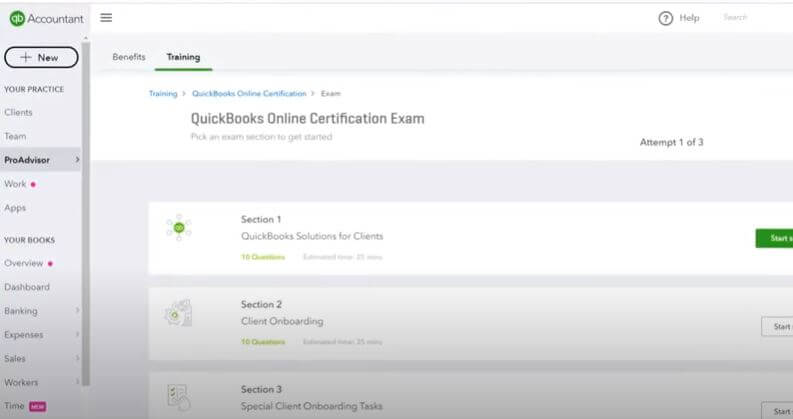

How to Give QuickBooks Online Certification Exam

You need to complete 3 steps to attend the QuickBooks Online Certification exam successfully. Here we have given the steps below, it will give you support to complete the exam process.

Step 1: Attend The Training Class

Attend a class for the examination. It will be the initial step for the certification. Find a class nearby you, and join. If in case, you have no facility to join the class in your location then you can join an online class.

Step 2: Be Ready for the Challenge

In the second step, you need to be prepared for the exam mentally as well as physically to attend the exam. Attempt all possible mock tests, and sample tests before the examination.

Step 3: Give Exam

Now you are in the final step to give your exam. Hopefully, it will be a fruitful result for you. Be calm, and give your exam.

Here, we have a video suggestion for you, that will help you to get the way for the Online Certification exam training. Have a look;

How to Prepare for the QuickBooks Certification Exam

You should follow different ways and different resources for better preparation. We have given some of the ways, by which you can prepare for the examination with 100 % satisfaction.

Get Certification Exam Answers PDF Supplements

Collect pdf supplements of the previous year’s questions, and do practice on them.

Technical Tips

Take the test in the INCOGNITO CHROME browser. You must do this.

To open the incognito Chrome browser, press CTRL + Shift + n. (On Mac, this is your command + shift + n). If you never go to “Secret”, don’t be afraid of the little friend of the sketch who looks like a detective and a black screen.

The reason you remain secretive is that sometimes there are some obscure computer computers inside the test center that may not work for no apparent reason. Then you want to cry because it was not recorded to show your test and you chat with the intuit help desk and they will tell you to “clear your cache” or some other computer. But you still have to take that test again. Anonymous gives you a clean, fresh start. As if you were taking it from a new computer.

Verify Both the Correct and Incorrect Answers

After giving a sample exam own self, you should check all of the questions with answers to know the answer that you have given is right or wrong. It will rectify your fault, and it will be easy to remember.

Take Screenshots Of the Exam You Have Passed

It will be good to take a screenshot after giving the examination as a prove.

Practice with Other Resources Also

- QuickBooks Certification – Intuit QuickBooks Training

- QuickBooks Advanced Certification Exam Answer PDF

- Free QuickBooks Practice Tests and Quizzes

- Beginner Test

- Experienced Test

- Advanced Test

Authentications Given by The Intuit QuickBooks ProAdvisor Program

Here is a list of authentication given by the QuickBooks ProAdvisor Program, have a look;

- QuickBooks authentication (desktop version)

- QB Online Certification

- QuickBooks Point of Sale Verification

- QB Enterprise Solutions Certification

So this is a sample exam question set for the examination. keep practice with these questions, and also refer to use exam-related pdf, video, and other kits. Hopefully, this informative article will be very helpful for you. If you want to get more information regarding this topic then you contact our QuickBooks ProAdvisor. They can guide you on the right path to reach your destination.