Are you looking for hiring an accountant for your small and medium business? An accountant is a person who helps you to manage your company or organization’s financial account and pay taxes. Additionally, they keep records of the financial account of your organization. And for these services you have to pay for them.

In business everything depends upon accounting for how much you spend and earn, a single mistake can ruin a business. To manage this earning and spending, a professional accountant, or CA (Chartered Accountant), is the best option. In simple words, an accountant handles your accounting work. Doing tasks such as paying taxes, managing accounts, suggesting business plans, keeping privacy etcetera.

Accountants act like a guide that always shows you the right direction in your business. Telling you how to set up your business, tracking expenses, and how to run efficiently and smoothly.

If you are doing a startup or are a businessman, you require an accountant who can handle the burden of your financial account. You don’t need to go anywhere to search for them. In a startup, there is a big challenge for entrepreneurs on how to grow, our accountants will help you. They are experienced, well educated, well trained, licensed accountants, and specialized in their profession.

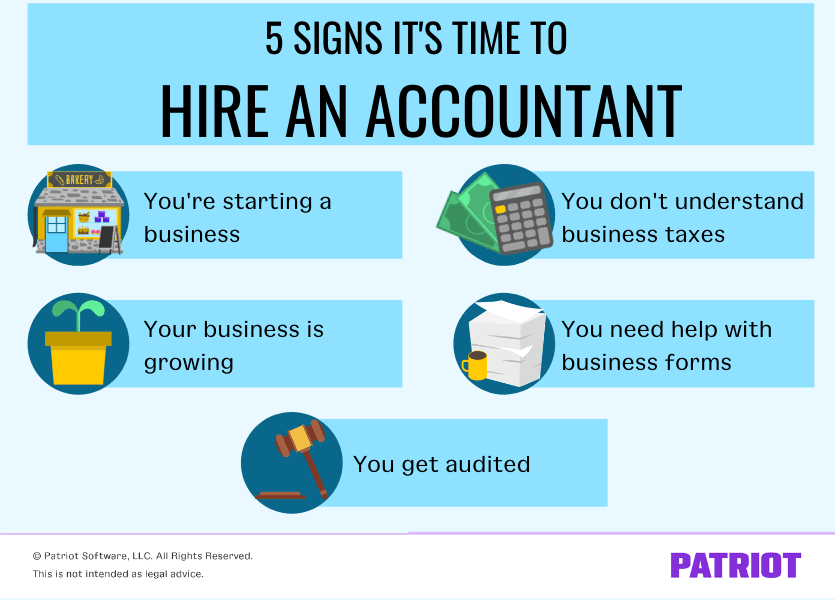

When You Need To Hire An Accountant

- You will need the advice of an accountant when you are doing business plans.

- For accounting and record-keeping.

- Acknowledging your company’s legal structure.

- Help with the finances.

- Needing help for your regular business operations.

- Advice related to tax.

Our accountants are perfect for all the tasks. Suggesting good advice to the clients, familiar with your business, making a strategic financial report, and also maintaining a good relationship with their customers. Various companies are working with us and are well-satisfied with the results of our accountants.

Things to Consider, While Hiring a Accounting Expert

If your company has the funds and is positioned to have strong business growth, it makes a lot of sense to bring on a full-time financial professional. You’ll have the peace of mind that a trained professional is keeping an eye on your company’s numbers at all times.

But, if your company isn’t ready to hire a new employee, then you should consider partnering with an external accounting firm. They’ll be able to manage the same financial tasks as an in-house accountant at a fraction of the cost. Regardless of which is right for your business, let’s cover what traits you should look for.

If you involve an accountant while you’re writing your business plan, they will be able to use accounting software to add financial projections and other reports to it. This will help you create a business plan that’s realistic, professional, and more likely to succeed.

Hiring a professional at this early stage will mean you get the benefit of their financial knowledge and advice right from the start. That could save you time and money compared with hiring one later.

Other Useful Resources:

Apply for Sales Tax Exemption and Get Refund Back in QuickBooks

How to Record (Paycheck Protection Program) PPP Loan Forgiveness in QuickBooks

Why to Hire an Accountant

Now you can grow more easily. An accountant can do more than just compiling and submitting taxes, such as:

- Creating a budget to achieve the target of your business.

- Save you from the audit by the IRS (Indian Revenue Service) officers.

- Prepare you for an audit and suggest you for leasing and the buying of goods and equipment.

- Suggest you on ejective tax payments.

- Able to use double bookkeeping that means two entries are made for each transaction, a debit in one account, and credit in another account.

- Calculating profit and loss data easily and accurately.

You should pay taxes because it is necessary for the development of the country. If you are late in tax payment, a penalty is added. Also, paying too much or too little tax can make you suspect in the eyes of the Income Tax Department. So our accountant pays tax properly according to law and helps you not get into such troubles.

Accounting not only means keeping the records of the money for the objective of paying tax but for saving money, price-cutting of equipment, and identifying the waste and fraud. Many of the businesses fall due to the mistake of accounting, even the successful ones.

So be alert about this topic as accounting is a critical point in the business that can make or break your business.

But you do not need to worry as you have great options to choose from, that being our accountants.

Here is a video suggestion for you, that will help you to find more reasons for hiring an accountant. Have a look;

Skills, Should Be Included in An Accountant

Specific skills when hiring an accountant.

- They have a specialized master’s degree from a recognized university.

- Good computer skills.

- Always updated knowledge about the market.

- They manage time carefully.

- Excellent communication skills with the clients, coordinator, and with employees.

- Experience in basic accounting transactions such as payroll, AP(Account Payable), and AR(Account Receivable).

- Able to finish their work in a given time and before.

Nowadays in the market, there are a lot of companies who are making software and say they can handle your accounts easily and can replace your professional accountants, which is not possible. It can help you a little but nothing more. These application helps you to manage accounts if you don’t want to expand your business. Such software cannot save you from the Income Tax audit, nor can prepare you for this situation.

What They Do to Run a Business in a Growing Manner

Fraud dealers will think a hundred times before cheating on you if you have a good accountant. Also, you can focus on your business without taking financial tension on the head. There is a plus point for the small and medium-sized businessmen that our accountants can manage your accounting without any computer program. It means you don’t need to spend your money on the other software accounting application.

If you hire a professional accountant or CA there is minimal chance of an Income Tax audit. Your accountant will help you in making good decisions and your future business plans with the knowledge of the market.

If you are an entrepreneur the accountant will help you to grow rapidly, advise you on whom to deal with. Making the report based on the financial forecast. If you are thinking to apply for a business loan, they will help you to create chances of getting a loan.

Your time is valuable for you as well as for us, which is why we will provide you only quality. You don’t have to worry about their salary as you can hire the best of the best accountant at affordable rates. Our accountant’s target is to bring you toward success so you can earn more and more profit and can expand your business all over the world. Check your business requirements before hiring an accountant.

Many companies, whether small or big, have hired our accountants and are being provided quality service. So without wasting your time just hire an Accountant or a Chartered Accountant and enjoy our services.