This software is for the upgrade of the Self-employed service provided by the QuickBooks accounting software company. You are using QuickBooks Self-Employed software for your freelancing work and for making some contracts. And your software does not satisfy you. So now you are thinking about making a change and want to switch to QBO then Move from QuickBooks self-employed to QuickBooks Online without any trouble. You may be wondering which software is best and how you can export your data online in QuickBooks. Don’t worry we will tell you everything about QuickBooks Online. You can also get help at the QuickBooks helpline through company customer care support which is very helpful and be always with the customer and solve their queries.

Difference Between QuickBooks Self-Employed & QuickBooks Online

QuickBooks Self-Employed

I know you know very well about QuickBooks self-employed as you are using this, but for a short intro let me tell you. This software is basically for those who want to work solo entrepreneur like Freelancers, real state agents, Ola/Uber drivers, and also independent consultant who wants to be self-employed and those who can file a Schedule c.

Schedule C:-

It is the process in which all the profit and loss report is submitted with a sale proprietor with a Personal Income Tax form 1040.

QuickBooks Online

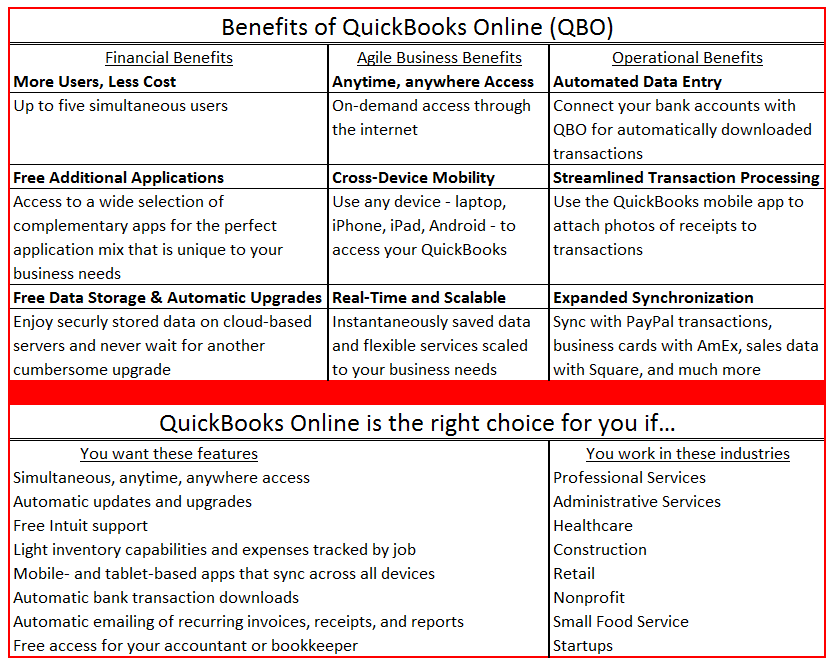

This is your ideal solution with which you are going to work with. If you have a service-based business with no need for an inventory management software system or complex invoice requirements then QuickBooks online is nothing for you because it is very helpful for making the track record on Inventory and also this software is very helpful in invoice making. QuickBooks Online is also the best option for companies that want access from multiple devices and have more than one person who needs access or who wants automatic updates from the cloud can take this software from the company.

| QuickBooks Online | Self-Employed |

|---|---|

| For small businesses | For freelancers, for the solo entrepreneur, and also for independent contractors. |

| Prepare Payroll | Not Prepare Payroll |

| Buy and Sells Products | File a Schedule C |

| Pay employees | Pays expenses by debit/credit card |

| Pay expenses By using debit or credit card | Writes not more than 5 checks per months |

| Track and pay 1099 contractors | No employees and no 1099 contractors to pay |

Steps to Move QuickBooks Self-Employed to QuickBooks Online

If you are getting success in your business, congrats, we are happy for you. Now the time came where you need something advanced version of QuickBooks accounting software to upgrade your work, right?. How is this idea to move from QuickBooks self-employed to QuickBooks Online? Well if you are also planning for these changes, then get ready with the following steps to involve QuickBooks online accounting software into your organization. It will help you with your finances as well as accountant-related work.

Step 1: Save All Financial Eeports

Before you start moving from QuickBooks self-employed to QuickBooks Online, download all of your work from QuickBooks Self-Employed. This is totally up to you, but it will be a better idea to hold on to your work for your records.

- Go to the Reports menu in your QuickBooks Self-Employed.

- Now from the Tax details section, choose the option tax year.

- Then click on the Download option to get a Tax Details report.

- You can now download a report for every tax year you have in your QuickBooks.

Step 2: Move Files to QuickBooks Online

Check that you can automatically move your files from QuickBooks self-employed into QuickBooks Online or not. For this, choose the Gear Icon and then select Billing info.

In case you are able to see the Explore QuickBooks Online plans, click on it to start the upgrade process.

In case you are not able to see the option, don’t worry because we will help you. In this case, you need to manually move your data into QuickBooks Online. We will let you know how to do that in the next section.

If you get the Explore QuickBooks option

- First of all, choose the option for the Switch plan or Choose a plan for the QuickBooks Online plan you need.

- You will have to now follow the on-screen steps.

- Now choose the option Bring my data in case you have to select which data you move over. In case you don’t have to move any data and start fresh, then select Start fresh.

- If you are totally ready to move your data from QuickBooks self-employed to QuickBooks Online, choose To QuickBooks Online. And here you will see a billing info review screen, click on the Change plan to start.

This process will take some time, so have the patience to get started with your new QuickBooks online plan.

Other Useful Resources:

Step 3: Export QuickBooks Self-Employed Data to QuickBooks online.

Here is the first step in which you can learn how to enter QuickBooks online from self-employed. Look at the below steps to export data from QuickBooks Self-employed:-

Step-1 – Start QuickBooks Self-Employed, then select the transaction from the navigation bar

Step-2 – Select the option to download the transaction in a CSV file

Step-3 – Name and save the CSV file

Step 4: Import data into QuickBooks online

In this, you are going to learn about importing all your data from self-employed to QuickBooks online. Here are the steps for importing data:

Step-1 – Open your registered company in QuickBooks Online.

Step-2 – Select banking from the navigation bar

Step-3 – Choose Upload File

Step-4 – Browse the location of your saved CSV file of the downloaded QuickBooks Self-Employed transaction

Step-5 – Map CSV data from QuickBooks Self-Employed to QuickBooks Online, confirm mapping of column names for import

Step-6 – Perform the necessary account mapping to map transactions to the QuickBooks Online chart of accounts. QuickBooks Self-Employed uses “categories” instead of actual charts of accounts. These “categories” do not convert, just as when using a bank feed, you have to map the transactions to the appropriate chart of accounts in QuickBooks Online.

Why to Choose QuickBooks Online

QuickBooks Online is the Best business accounting software for small to medium-sized business owners. Here are the best 4 reasons why you should use QuickBooks Online.

- You save time on bookkeeping and paperwork because many of the functions of bookkeeping are automatically controlled making it easier to run your business.

- Allow you to easily create a report with the information you need, so you always know where your business stands. And you know immediately whether you are making money or not and whether your business is healthy or not.

- Also, you can save your money because QuickBooks online is affordable accounting software. You can use it to run a $ 5 million or $ 25 million business for a few hundred bucks. PC accounting software is actually one of the great bargains in business.

- Your business can grow with and QuickBooks will help you when you secure your small business loan or line of credit or plan for the future. QuickBooks will create an estimated balance sheet, profit and loss statement, and statement of cash flows in a format suggested by the Small Business Administration of America.

In this blog, we have tried to tell you something about switching to QuickBooks Online from self-employed. How can you take your self-employed data into the QuickBooks online also we have listed some of the differences between Self-employed and QuickBooks online. I hope You liked the blog if you have any queries related to this topic kindly go for the QuickBooks support line +1-844-405-0904.